Ontario’s iGaming Landscape: Q2 FY 2024-25 Market Performance

Posted on: October 26, 2024, 10:22h

Last updated on: October 26, 2024, 10:22h

In a promising report released by iGaming Ontario, financial data for the second quarter of fiscal year 2024-25 showcases a robust market that has significantly matured. Paul Burns, President and CEO of the Canadian Gaming Association, articulated that the figures indicate a sustained upward trajectory, echoing sentiments of growth and stability within the province’s online gaming landscape.

Market Overview: A Financial Snapshot

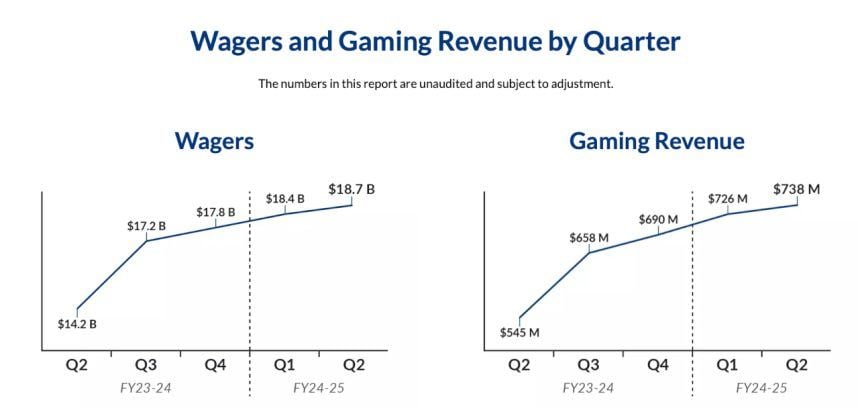

The iGaming Ontario market performance report highlighted that total wagers in Q2 reached a staggering $18.7 billion, marking a 1.6% increase from the previous quarter and a 31.7% rise compared to the same period last year. This upward trend underscores the resilience and expansion of the market since its launch in April 2022.

Revenue Growth

Accompanying the increase in wagers, total gaming revenue for the quarter was $738 million, representing a 1.7% increase from Q1 and a noteworthy 35.4% jump year-over-year. The financial results, however, do not account for revenues generated through the government-operated Ontario Lottery and Gaming Corporation platform, which primarily functions alongside the competitive iGaming market.

Insights from Leadership: A Market Maturing

According to Burns, the trends observed in the iGaming space are a hallmark of a mature market rather than a nascent one. He noted the importance of operators stabilizing their positions as advertising efforts plateau. “Operators have hit their stride, advertising is leveling off, and AGCO and iGO are still admitting more operators into Ontario to replace the handful that have left,” said Burns during his presentation at G2E earlier this month.

A Diverse Gaming Environment

As it stands, there are 51 operators and 83 licensed gaming websites actively engaged in the Ontario market. Despite an overall decrease in active player accounts—down to 1.32 million from 1.9 million in Q1—the average monthly spend per active account saw an increase to $308, up from $284 in the previous quarter. This statistic indicates that while fewer players participated, they were wagering more actively.

Segment Analysis: Casino Dominance

Breaking down the market further, the casino segment continues to hold a commanding presence, accounting for an impressive 86% of total wagers ($16 billion) and generating 75% of gaming revenue ($553 million). Following this, sports betting (including esports, proposition, and novelty bets) constitutes 12% of total wagers ($2.2 billion), contributing 23% to gaming revenue ($167 million). The peer-to-peer poker segment trails with 2.2% of total wagers ($417 million) and 2.4% revenue ($18 million).

Looking Ahead: Future Developments

As Ontario’s gaming market flourishes, other provinces, such as Alberta, are beginning to explore similar regulatory frameworks to tap into the potential revenue streams from online gaming. Alberta plans to launch its own Ontario-style iGaming regulatory regime sometime in 2025, a move that signals growing adoption of digital gaming across Canada.

Conclusion: A Positive Outlook for Ontario

As we progress through FY 2024-25, the results from iGaming Ontario’s latest report reflect a robust and evolving landscape that shows no signs of stagnation. The combination of increased wagers, rising revenues, and a maturing market suggests long-term sustainability for both the province and the industry. As regulatory bodies continue to welcome operators and refine the gaming framework, Ontario is poised to maintain its position as a leader in the Canadian iGaming ecosystem.

The positive developments in Ontario’s online gaming market serve as a testament to its adaptability, competitiveness, and potential for future growth. As the industry continues to evolve, stakeholders and players alike will undoubtedly benefit from this dynamic ecosystem.